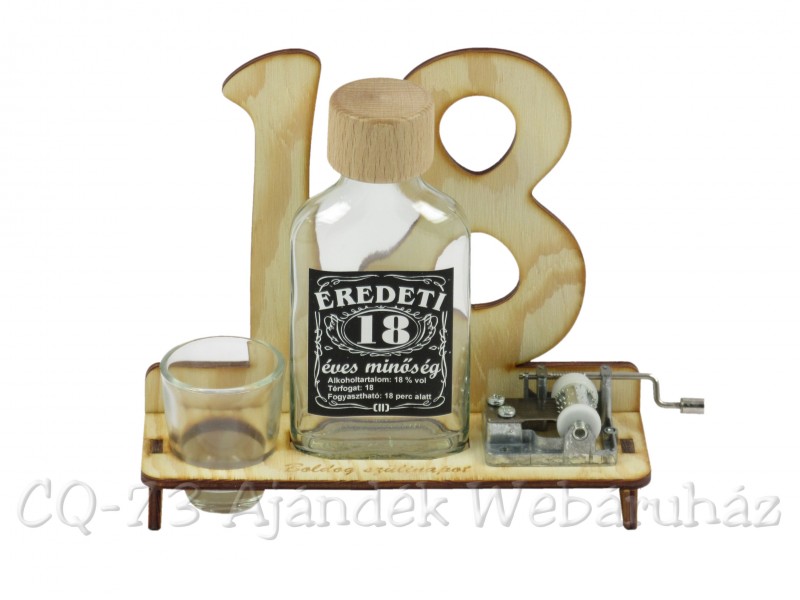

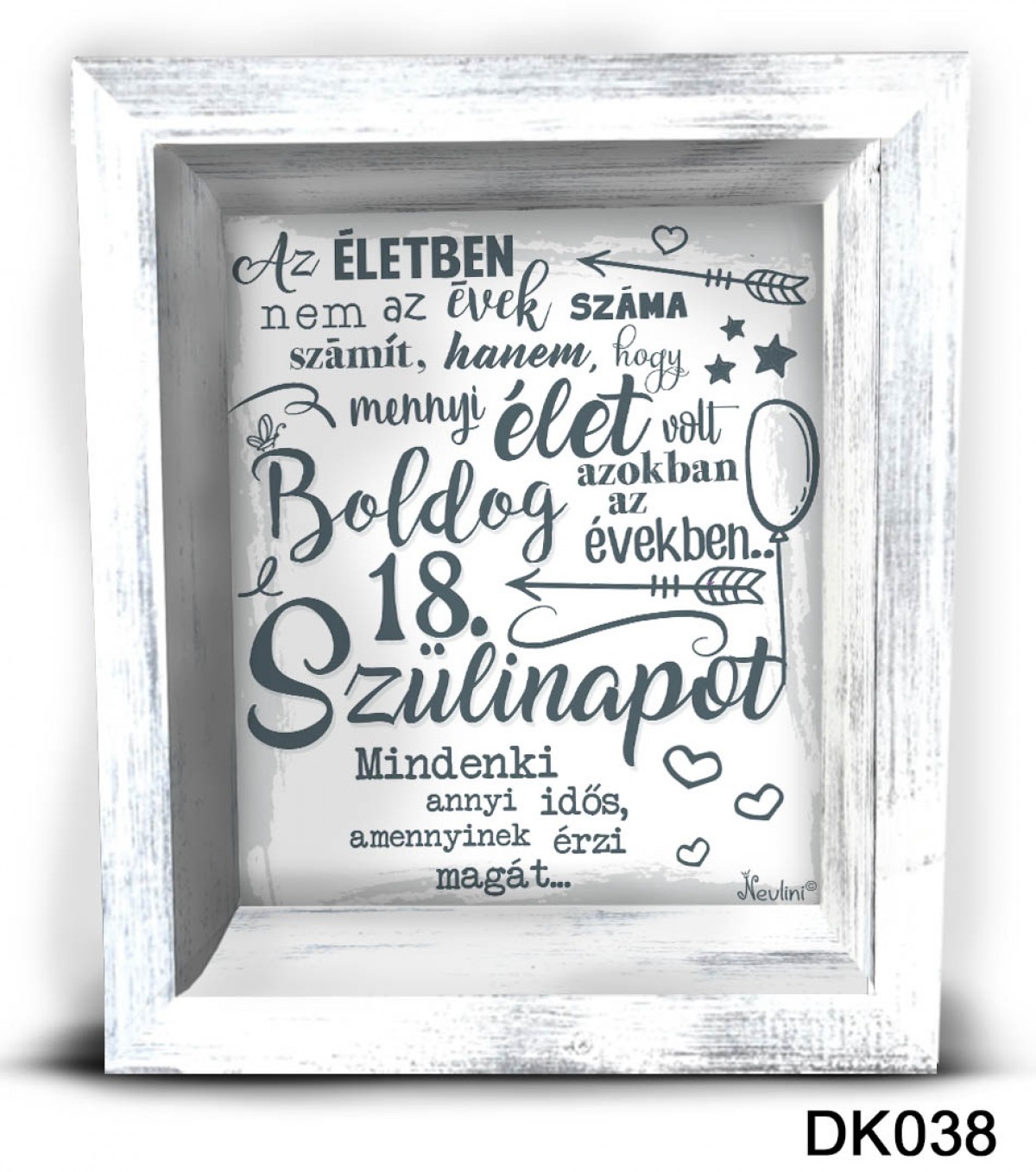

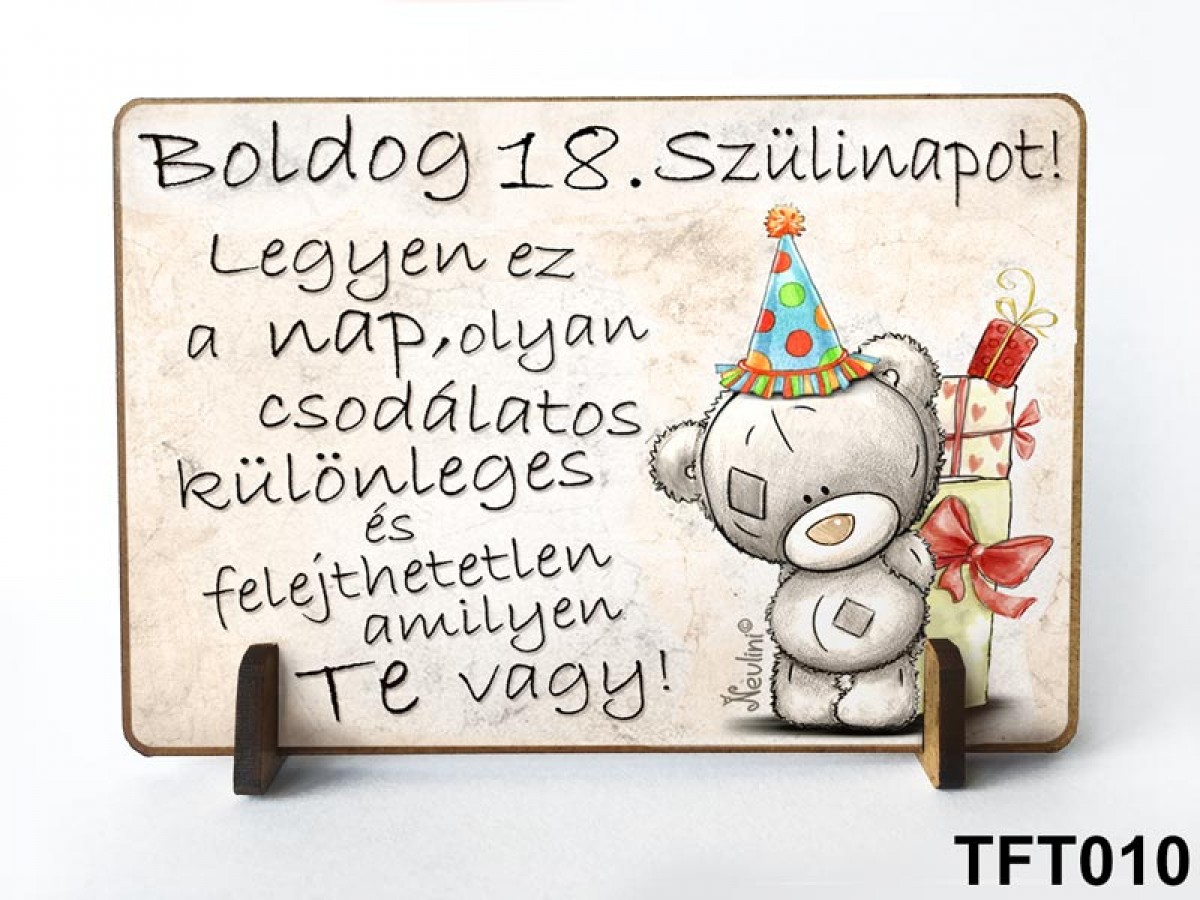

18. Szülinapi Ajándékok | Születésnapi Ajándék Ötletek | Nevesajándék.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek

18. Szülinapi Ajándékok | Születésnapi Ajándék Ötletek | Nevesajándék.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek

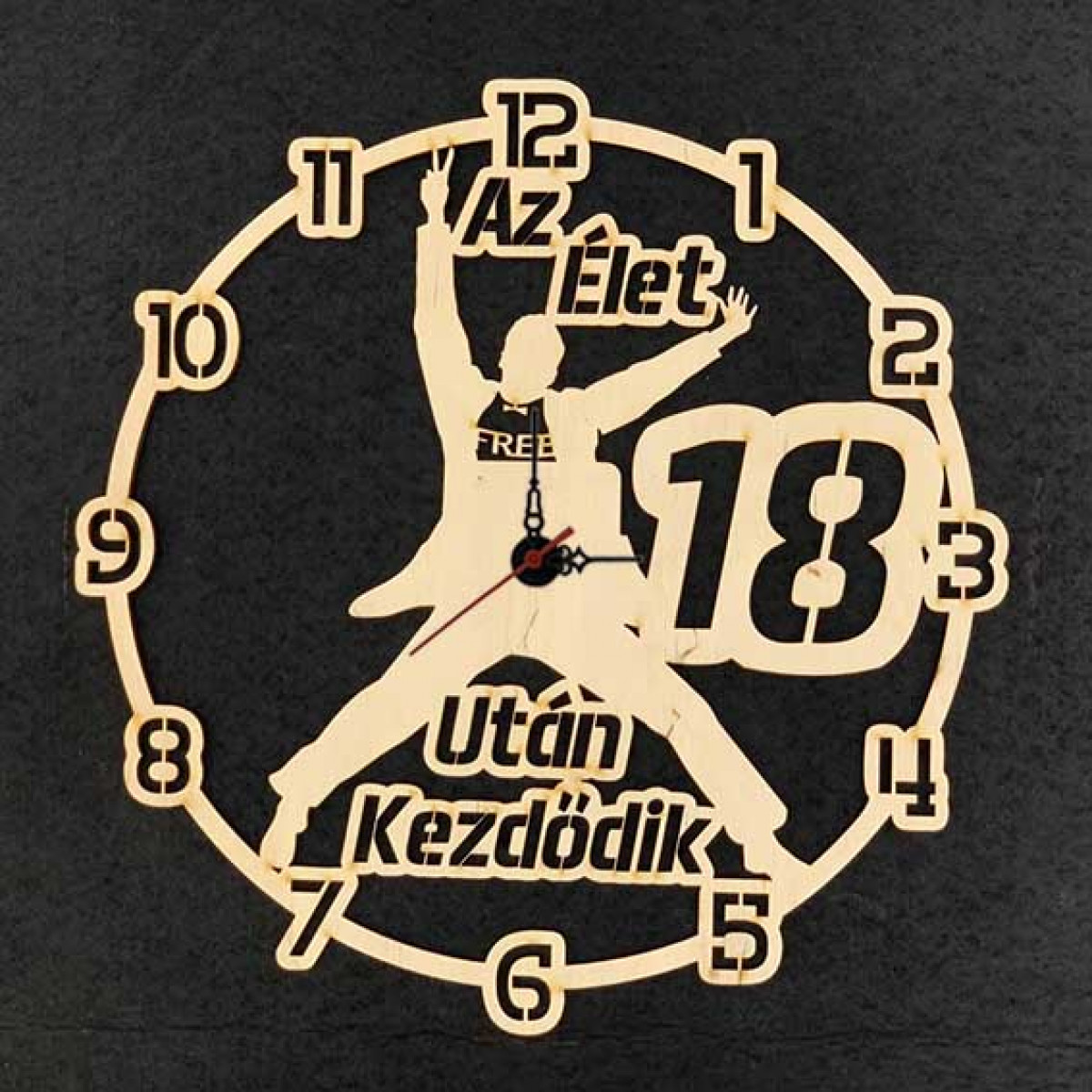

18. Szülinapi Ajándék | Falióra | Nevesajándék.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek

18. Szülinapi Ajándékok | Születésnapi Ajándék Ötletek | Nevesajándék.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek

18. Szülinapi Ajándékok | Születésnapi Ajándék Ötletek | Nevesajándék.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek

18. szülinapi ajándék | Ajándék Férfiaknak és Nőknek | Nevesajandek.hu < Nevesajandek.hu | Ajándék Webáruház | Ajándék Ötletek